While a car or bike, or sell your bike, you will need to get Transfer Vehicle Ownership . Nowadays, vehicle ownership transfers are very important because the owner’s name appears on the registration book and the buyer wishes to have their name on it. Read this article if you want to transfer your name vehicle to another person’s name. If you want to sell an old vehicle, you must transfer ownership to the buyer.

Transfer Vehicle Ownership online

Nowadays, all vehicle ownership services can be completed online through the Parivahan portal. When we say ownership transfer within a state, we mean within the state’s geographical boundaries. Let’s say our car was registered in Delhi, and we sold it within Delhi. The transfer of ownership of a vehicle or the sale of a vehicle to another person is considered a normal sale. A NOC of the vehicle is required in this case.

Required Document and Fees for Transfer Vehicle Ownership

- A certificate of no objection (NOC)

- To change ownership, fill out Form-29 and Form-30, and print out the chassis number with a pencil.

- When changing ownership through inheritance, Form 31 should be used. For changing ownership through a public auction, Form 32 should be used.

- Along with the application, an original copy of the R.C. Book, Insurance Certificate, PUC Certificate, proof of identity, and address must be attached.

- As a transfer fee, two-wheelers must be paid Rs.150/- and motor cars must be paid Rs.300/-.

- As transfer tax, a lump sum tax @ 15% of the original lump-sum tax is required, however, if the vehicle is more than 8 years old, then a tax @ 1% or Rs.100/- whichever is higher is required.

Transfer Vehicle Ownership from any states

Read More | How to Apply Driving Licence ?

Process for Transfer Vehicle Ownership online in Delhi

You can Transfer Vehicle Ownership by following these steps :

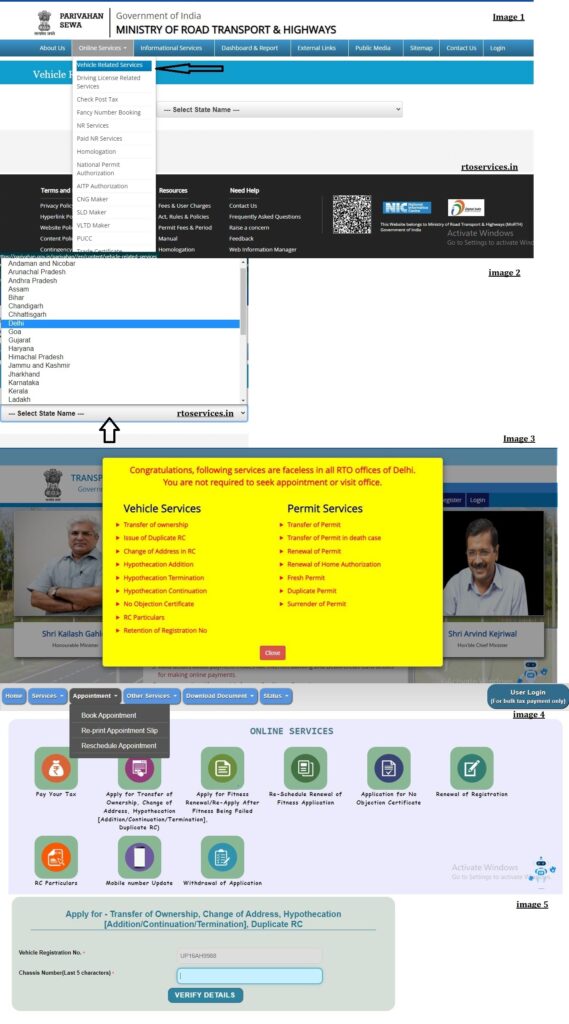

- To get started, you must first obtain a No Objection Certificate (NOC) from the seller. Next, open the official website of Parivahan at https://parivahan.gov.in/parivahan/ and select the menu from Online Services >> Vehicle-related Services.

- Select your state now

- Click on Proceed after selecting your RTO of vehicle registration.

- You may apply online for Transfer of Ownership, Address Change, and Hypothecation (Addition/Continuation/Termination, and Duplicate RC).

- Click on the VERIFY DETAILS button and enter your vehicle’s VIN number and the chassis number (last 5 characters).

- Your vehicle’s details will be displayed now. On this page, you can see all the details about your vehicle. Who is the owner of your vehicle, when was it registered, and when does your vehicle’s insurance expire? All this information can be found here.

- Next, you need to move down to the bottom of the screen where you will see the fees for the car or bike transfer.

- You should double-check your complete information once again, as well as the name and address of the person in whose name you want to do the car. If all the details are correct, you can select the payment method. You can pay online and submit the application.

- Finally, the applicant screen will display the Stage Confirmation box. Click Next to proceed.

- Upon payment, your application is submitted and a reference receipt is generated. This receipt is required for further processing. The next step is to pay your pending vehicle tax. Transfer Vehicle Ownership

Check the image to Understand all the Procedures

The procedure of paying pending tax of vehicle in Delhi

If you wish to transfer ownership of the vehicle, you must first pay any pending taxes and then you will be granted the transfer of ownership. The following steps illustrate how to pay vehicle taxes.

- Visit the Vahan parivahan website at https://vahan.parivahan.gov.in/vahanservice/, open the official site, select the state, RTO, and click on the proceed button.

- You can pay your taxes on the main menu by selecting RC-related services.

- You can now enter your vehicle registration number and see how much is pending your vehicle tax.

- Use a net banking or debit card to pay your pending vehicle tax online. Once you successfully pay your vehicle tax, you can proceed with transferring ownership.

Transfer of ownership on death of the owner of the vehicle

If the registered owner dies, the legal heirs of the deceased registered owner are entitled to the transfer of ownership. In the event of the death of the owner of a motor vehicle, the person succeeding to the possession of the vehicle may, for a period of three months, use the vehicle as if it had been transferred to him, provided such person informs the registering authority within thirty days of the occurrence of the death and his own intentions to use the vehicle.

Guidelines

Transfer of ownership on death of the owner of the vehicle

- Form 31 must be submitted to the registering authority within three months for the transfer of ownership of the vehicle in your name

- According to the Central Motor Vehicle Rules 1989, rule 81 specifies the fees and taxes to be paid.

Transfer of ownership on death of the owner of the vehicle

- Form 31

- Certificate of registration

- Certificate of insurance

- Death certificate in relation to the registered owner

- Certificate of pollution under control*

- PAN card (successor) or Form 60*

- Chassis & Engine Pencil Print*

- Proof of Date of Birth of successor*

- Proof of address*

- Signature Identification of Seller*

- Declaration by the applicant and all other Legal Heirs of the deceased*

- Verification of vehicle on Form 20*

- R.C. Book

- Passport size photograph*

- Proof of succession*

FAQ ON Transfer Vehicle Ownership

Ques- What is the process of transferring ownership?

Step 1 – Notarize the contract of sale

Step 2 – Fill out and submit the necessary documents

Step 3 – Hand over all necessary documents

Step 4 – Obtaining a certificate of clearance

Step 5 – Apply for a transfer of ownership at the new RTO

Ques- Can I do a change of ownership online?

Ans- Yes You can do that Process Online.

Ques- When should I transfer ownership of a vehicle?

Ans- Application for vehicle ownership transfer must be made within 14 days after the sale or purchase.