If you’ve ever had an accident, it’s not always obvious how to proceed when it comes to claiming your car insurance. Here below are 3 Simple Steps To Claim Car Insurance After An Accident

Why do I need to Claim Car Insurance After An Accident ?

There are a few reasons why you need to Claim Car Insurance After An Accident

- The first reason to Claim Your Car Insurance is that it will cover the cost of any damages that were caused by the accident. This includes damage to your car, as well as any property that was damaged in the accident.

- Second reason to claim your car insurance is to protect yourself from any legal liability that may arise from the accident. If you are found to be at fault for the accident, you could be sued by the other driver or their insurance company. By claiming your car insurance, you will have financial protection against any potential lawsuits.

- Third reason to claiming your car insurance is can help to improve your rates in the future. Insurance companies often offer discounts to drivers who have a good claims history. So, if you file a claim after an accident, it could save you money on your car insurance premiums in the long run.

- How to change address in vehicle registration certificate RC

- How to get a Duplicate Vehicle Registration certificate RC ?

- How to check my vehicle e-challan online?

How to Claim Car Insurance After An Accident ?

After an accident, the first thing you should do is file a police report. Once you have a copy of the police report, you can file a claim with your car insurance company. Most companies have an online claims process that you can follow.

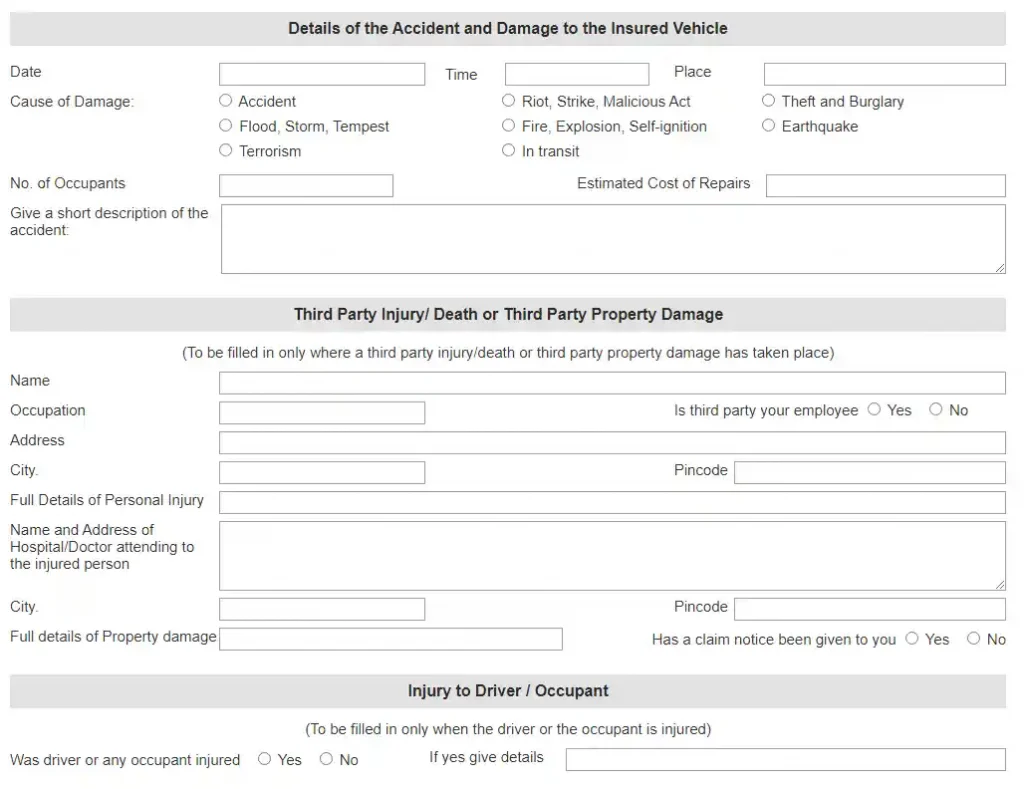

In order to file a claim, you will need to provide your insurance company with some basic information about the accident, such as the date and time it occurred, where it happened, and what happened. You will also need to provide the police report number.

Once you have filed your claim, your insurance company will assign an adjuster to your case. The adjuster’s job is to investigate the accident and determine how much the insurance company should pay for the damages.

If you are not happy with the amount offered by the insurance company, you can negotiate with the adjuster. If you still cannot reach an agreement, you can hire an attorney to help you fight for a fair settlement.

motor insurance claim form Some Insurance Companies

Download the Claim Form of These Companies to Claim Car Insurance After An Accident

| Tata Aig insurance Claim Car Insurance After An Accident | motor insurance claim form Cholamandalam |

| motor insurance claim form new India assurance | motor insurance claim form Hdfc ergo |

| royal Sundaram motor insurance | motor insurance claim form Digit |

| motor insurance claim form Icici Lombard | motor insurance claim form liberty |

Documents required to make a Claim Car Insurance After An Accident

If you’re involved in a car accident, there are a few documents you’ll need to file a claim with your insurance company. First, you’ll need a copy of the police report. This will document the details of the accident and who was at fault. You’ll also need to provide your insurance company with a copy of your medical bills if you incurred any injuries. Finally, you’ll need to send over any repair estimates if your car was damaged in the accident.

In order to make a valid car insurance claim after an accident, you will need to gather and submit the following documents: Claim Car Insurance After An Accident

- Police report – This will document the details of the accident, including who was at fault. It is important to obtain a police report even if the other driver denies responsibility, as this can be used as evidence later on.

- Photos of the accident scene and damage to your vehicle – These will help support your claim and serve as visual documentation of what happened. Try to take clear, wide-angle shots that show all relevant details such as skid marks, debris, and damage to vehicles.

- Statements from witnesses – If there are any witnesses to the accident, get their contact information and ask them if they would be willing to provide a written or recorded statement detailing what they saw. This can be extremely helpful in proving your case.

- Your own account of what happened – Write down everything you remember about the accident while it is still fresh in your mind. Include details such as weather conditions, road conditions, what you were doing prior to the accident, etc. This will serve as your personal testimony should any disputes arise later on.

How to avoid making a false claim

It is important to avoid making any false claims when claiming for car insurance after an accident. Here are some simple tips to avoid making a false claim:

– Be honest about the circumstances of the accident. Do not try to downplay the severity of the incident or withhold any information that may be relevant.

– Do not exaggerate the extent of damage to your vehicle or the injuries you have sustained. This will only lead to problems further down the line if your claim is found to be fraudulent.

– Make sure you have all the necessary documentation to support your claim, such as police reports, medical records, and receipts for repairs. Do not try to make a claim without avantagesous six months later

What are my other options for claiming

There are a few different ways that you can go about claiming your car insurance after an accident.

The first and most common way is to simply file a claim with your insurance company. This is usually the quickest and easiest way to get your claim processed and paid out.

Another option is to file a third-party claim with the other driver’s insurance company. This can sometimes be necessary if the other driver was at fault for the accident, or if your own insurance company is unwilling or unable to pay out on your claim.

finally, you can also choose to file a personal injury lawsuit against the responsible party. This is usually only necessary if you’ve suffered serious injuries in the accident and are seeking compensation beyond what your insurance will cover.

FAQ on Claim Car Insurance After An Accident

How many days after the accident we can claim for car insurance?

However, the insured should report the accident within seven days of the accident. Some insurers have a window of 48 to 72 hours from the time of the accident to file a claim.

What is the procedure to claim car insurance?

If you’re involved in a car accident, there are a few things you need to do to make sure you’re able to claim your car insurance.

Here’s a quick step-by-step guide:

Make sure you exchange details with the other driver – you’ll need their name, contact details and insurance information.

Take photos of the damage to both vehicles, as well as any injuries sustained.

Call your insurance company and report the accident. They’ll need all of the same information that you gave to the other driver, so have it ready when you call.

Your insurance company will then assess the damage and decide whether or not your claim is valid. If it is, they’ll arrange for repairs to be carried out.

You may be required to pay an excess on your claim, depending on your policy terms and conditions. This is typically a few hundred dollars.

Once repairs are completed, you’ll be able to drive your car again!

Conclusion

Making a Claim Car Insurance After An Accident , but it doesn’t have to be. By following these three simple steps — gathering information, contacting your insurer, and documenting the damages — you can make the process as smooth and stress-free as possible. And if you’re ever in doubt about what to do or how to proceed, don’t hesitate to reach out to your car insurance company for help. They’re there to assist you every step of the way.